When it comes to Discount Car Insurance Quotes: How to Save Big in New Zealand, there are key strategies that can make a significant impact on your insurance costs. From understanding different discounts to leveraging technology for savings, this guide will take you through everything you need to know to get the best deals on car insurance.

Understanding Car Insurance Discounts

When it comes to car insurance in New Zealand, discounts play a crucial role in helping policyholders save money on their premiums. Insurance companies offer various discounts to incentivize safe driving behavior, loyalty, and other factors.

Common Discounts Offered by Insurance Companies:

- Multi-policy discount: Customers who bundle their car insurance with other types of insurance, such as home or contents insurance, can often enjoy a discount.

- No-claim bonus: Insurers reward policyholders who have not made any claims during a specific period with a discount on their premiums.

- Safe driver discount: Drivers with a clean driving record and no history of accidents or traffic violations may be eligible for a discount.

- Low-mileage discount: Policyholders who drive fewer kilometers than the average driver may qualify for a discount based on their reduced risk of accidents.

- Age-based discount: Young drivers under 25 or senior drivers over 65 may receive discounts based on their age group's lower risk profile.

Factors Affecting Car Insurance Quotes

When it comes to car insurance quotes in New Zealand, several factors come into play that can significantly impact the cost of your premium. Understanding these factors and how they influence your insurance quotes can help you make informed decisions to save money.

Age

Age is a crucial factor that insurance companies consider when determining car insurance quotes. Younger drivers, especially those under 25, are often charged higher premiums due to their lack of driving experience and statistically higher likelihood of being involved in accidents.

On the other hand, older drivers, typically over 50, may benefit from lower insurance rates as they are considered more experienced and less risky.

Driving History

Your driving history directly affects your car insurance quotes. If you have a clean record with no accidents or traffic violations, insurance companies are more likely to offer you lower premiums. On the contrary, if you have a history of accidents or speeding tickets, you may face higher insurance costs as insurers perceive you as a higher risk driver.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your car insurance quotes. High-performance cars, luxury vehicles, and sports cars are generally more expensive to insure due to their higher repair costs and increased likelihood of theft.

On the other hand, economical, safe, and low-risk vehicles typically come with lower insurance premiums.

Tips for Saving on Car Insurance

When it comes to saving on car insurance in New Zealand, there are several strategies you can employ to get discount quotes and lower premiums. It's important to be proactive and explore different options to find the best deal for your specific needs.

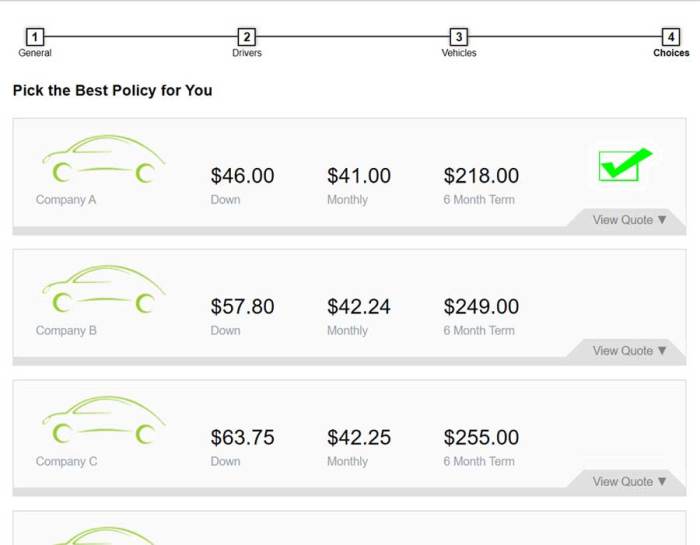

Shop Around and Compare Quotes

One of the most effective ways to save on car insurance is by shopping around and comparing quotes from different insurers

Tailor Coverage to Your Needs

Another way to save on car insurance is by tailoring your coverage to your specific needs. By customizing your policy and only including the coverage you need, you can avoid paying for unnecessary extras and lower your premiums.

Utilizing Technology for Savings

In today's digital age, technology plays a crucial role in helping individuals save money on car insurance. From telematics devices to online comparison tools, there are various technological advancements that can lead to discounted car insurance premiums in New Zealand.

Telematics Devices

Telematics devices, also known as black boxes, are small devices that are installed in your vehicle to monitor your driving behavior. By tracking factors such as speed, acceleration, braking, and cornering, insurance companies can assess your risk level more accurately.

This data can lead to personalized premiums based on your actual driving habits, potentially resulting in lower rates for safe drivers.

Online Comparison Tools

Online comparison tools have revolutionized the way consumers shop for car insurance. These tools allow you to compare quotes from multiple insurance providers in a matter of minutes, helping you find the best deal that suits your budget and coverage needs.

By leveraging technology to compare prices and coverage options, you can potentially save hundreds of dollars on your car insurance premium.

Pros and Cons of Using Technology for Savings

- Pros:

- Personalized premiums based on actual driving behavior

- Convenience of comparing quotes online

- Potential for significant cost savings

- Cons:

- Privacy concerns related to data collection

- Possibility of technical malfunctions affecting premiums

- Limited availability of telematics programs from insurers

Final Review

In conclusion, Discount Car Insurance Quotes: How to Save Big in New Zealand offers valuable insights into maximizing your savings on car insurance. By implementing the tips and tricks discussed here, you can ensure that you are getting the most cost-effective coverage tailored to your specific needs.

FAQ Resource

What are some common car insurance discounts offered in New Zealand?

Common discounts include multi-policy discounts, safe driver discounts, and loyalty discounts.

How can I leverage my driving history to lower insurance costs?

Maintaining a clean driving record can often lead to lower premiums as insurers view you as a lower risk.

Is it worth using technology like telematics devices to save on car insurance?

Using telematics devices can be beneficial for safe drivers as it can lead to personalized discounts based on your driving habits. However, it may not be suitable for everyone.